PETALING JAYA: The outlook for Malaysian fixed income remains neutral on valutation, albeit favourable on domestic activities according to a note by AmResearch.

It said demand for bonds would last throughout the year, but valuation wise, it may appear expensive with the 10-year Malaysia Government Securities (MGS) yield about 75.3 basis points lower from the start of 2019.

“There is a less cautious outlook on the potential exclusion of the MGS from the World Government Bond Index (WGBI) by FTSE Russell. Continued discussion between Bank Negara Malaysia and FTSE Russell indicates both parties aim to prevent a market disruption. It implies the risk of MGS withdrawal from the WGBI is manageable,” it said.

At the same time, there is a positive impact from Budget 2020 with more money to be spent on development expenditure and resumption of mega infrastructure projects.

“[This] should boost activities in the construction/infrastructure sector, added with the year 2020 being Visit Malaysia Year as well as Apec should benefit retail businesses.

“SMEs should keep the overall economic momentum on a positive note. Private consumption will remain the growth anchor with exports complementing. Room for another Overnight Policy Rate cut acts as a potential catalyst,” it said.

The research house also noted that onshore liquidity remains ample, as the appetite for local currency is healthy with the expectations of another potential rate cut this year, lack of government-guaranteed corporate bond issuance and healthy cash levels amid subdued credit growth.

Meanwhile, with the government’s fiscal deficit to gross domestic product ratio at 3.2%, it will require RM51.7 billion in financing.

“With the incoming maturities at RM73.4 billion, the estimate of the gross issuance of government bonds will be around RM125 billion. Our estimation does not take into consideration of the switch auction that can trim maturities in 2020 and any potential new issuance of Samurai bonds,” said AmInvestment Research.

In terms of total corporate bond issuance, in 2019, it fell 7.2% year-on-year (yoy) to RM92.8 billion, slightly higher than AmResearch’s estimation of RM80-90 billion.

The 2019 print excludes Urusharta Jemaah’s RM27.6 billion – non-tradable and non-transferable sukuk. The overall softer issuance print was driven by weaker government guaranteed prints, down 13.7% yoy to RM33.6 billion in 2019 from RM38.9 billion in 2018.

“Looking ahead into 2020, the private debt securities (PDS) issuance is more likely to hover between RM85 billion and RM95 billion. It will continue to be supported by government guarantees papers due to the resumption of suspended mega infrastructure projects,” said AmResearch.

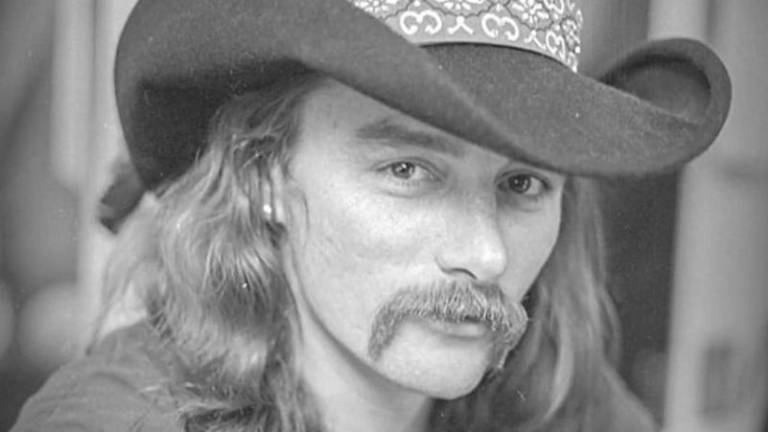

Positive impact from Budget 2020 with more money for development expenditure. – BERNAMAPIX