PETALING JAYA: The Malaysian property market has been luring foreign investors back as the ringgit depreciated, according to Juwai IQI’s Q3’22 Economic Outlook report.

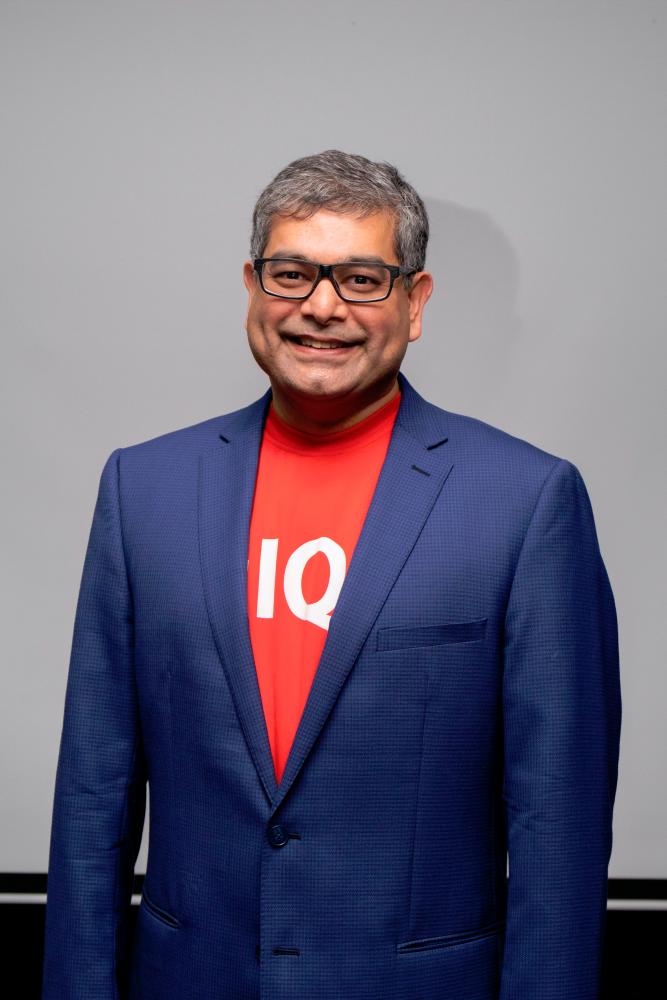

Juwai IQI co-founder and group CEO Kashif Ansari (pix) said the weakening ringgit is part of the appeal of Malaysian property that has been luring foreign investors back into the market.

“Foreign investment benefits from exchange rate trends. The ringgit has lost 6% of its value against the dollar so far this year and is down 13% from its 2018 high against the greenback,” he said.

Additionally, the reopened borders are already having an impact on the property market and tourism industry. Juwai IQI believes the economy and property market have enough momentum to absorb the increases in stride without falling into a down cycle.

Malaysia is also benefiting from the commodities boom, higher exports, strong foreign direct investment, and the recovery in domestic demand.

Bank Negara Malaysia began tightening the overnight policy rate in May and has since moved the rate up from 1.75% to 2.25%. The country’s banks have moved in lockstep, pushing the base lending rate up to 5.9% per annum.

“While these moves represent an increase from the extraordinarily low levels that prevailed for the past two years, interest rates remain historically low to support the property market,” added Kashif.

Real GDP growth is expected to reach 5.7% this year, second only to the Philippines among the countries in this report. The impact of the Russian invasion of Ukraine on global energy prices has also benefited Malaysia, which is Southeast Asia’s second-largest producer of oil and gas and a net exporter.

Foreign direct investment has been strong, and the country attracted RM27.8 billion in the first quarter of 2022, according to the Ministry of International Trade Industries. The manufacturing sector accounted for the majority of investment, which will increase capacity and allow Malaysia to capture additional market share.

Domestic demand and household income are also climbing, as the unemployment rate works its way in steps back down to pre-pandemic levels. After reaching a high of 4.8% in 2020, the average 2022 unemployment rate is forecast to be 3.6%. Juwai IQI said it should hit 3.4% in 2023, close to 3.2% of the year before the pandemic.

Inflation will peak this year at 3.2% before falling in 2023 to 2.8%. Food and fuel subsidies and some export restrictions are helping combat inflation, but higher employment and an increase in the minimum wage provide upward pressure. Increases in the consumer price index are expected to decline from 2.5% in 2021 to 3.2% this year, before dropping again to 2.8% in 2023.