PETALING JAYA: Semiconductor firm Frontken Corp Bhd reported a net profit of RM18.20 million for its fourth quarter ended December 31, 2019, a 2.6% decline from RM18.68 million in the previous corresponding period, due to higher taxation and lower other operating income.

Its revenue was flat at RM88.89 million against RM88.67 million reported previously.

Frontken told Bursa Malaysia that its subsidiaries in Taiwan and Malaysia recorded a higher revenue during the quarter as its customer ramped up production in Taiwan and improvement in oil and gas subsidies in Malaysia.

However, its subsidiaries in Singapore and the Philippines saw a lower revenue due to operational issues experienced by their customers that resulted in some works being requested to be put on hold.

For the full financial year, Frontken’s net profit expanded 32.4% to RM69.17 million from RM52.26 million a year ago, while revenue rose 3.9% to RM339.91 million from RM327.22 million.

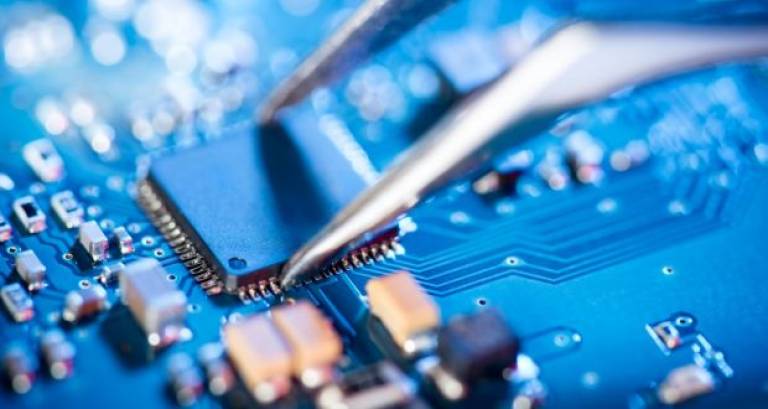

Commenting on the prospects, Frontken believes that the global demand for semiconductors, which remains strong in the long term, will continue to grow.

“According to IHS Markit, the deployment of 5G will be the main factor propelling a recovery for the semiconductor industry from the significant downturn in 2019, not only

because of the renewed growth it will bring to the wireless industry, but also due to the wider benefits the wireless technology will bestow on global businesses and economies.”

Meanwhile, Frontken noted that the improved performance in its oil and gas business in 2019 augurs well for its business in the next few years as it was appointed as one of the panel contractors for the provision of manpower supply and also mechanical rotating equipment services and parts for Petronas.

“However, the group anticipates that the overall business conditions in 2020 will continue to be challenging amid the growing concern over the economic damage caused by the spread of the Covid-19 virus.”

“Although our customers have indicated that their businesses are currently not affected by the extended lunar new year break in China, most are unable to predict the impact should the situation prolong.”

At 3.20pm, Frontken’s share price was down 6 sen to RM2.44 on 8.05 million shares done.