PETALING JAYA: Malaysia’s automotive sales are forecast to remain strong for the next six months, according to AmBank Research.

In a research note today, it said its optimism stems from robust order backlogs, healthy booking trends, new model launches and facelifts to current models in the market.

Model debuts during the month, including the all-new Honda City and Toyota Corolla GR Sport along with its updated model, are anticipated to support the sales volume over the coming months.

“Also, our view is supported by steady employment and firm 2023F-2024F GDP growth of 4%-4.5%, which will continue to support resilient domestic spending,” it added.

The Malaysian Automotive Association reported that the total industry volume (TIV) for August increased 12.7% month-on-month (m-o-m) to 71,745 units as sales volume of passenger cars grew by 12% to 64,633 units, whereas the commercial segment rose 24% to 7,112 units. The growth was attributed to the National Day promotional campaign and improved automotive supply chain ecosystem.

On a year-on-year (y-o-y) basis, TIV increased 6.2%, mainly supported by the growth of Mazda (+37%), Perodua (+20%) and Toyota/Lexus (+13%). However, sales of Nissan/Renault fell 26%. The strong sector performance in August resulted in a TIV year-to-date (YTD) sales of 498,842 (+11% y-o-y), which is on course to reach the research house’s 2023 TIV target of 650,000 units.

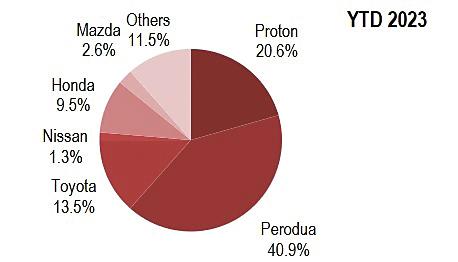

National carmakers Proton and Perodua continued their dominance, with more than 60% of the market share.

Perodua took pole position, as its total market share grew to 40.9% (+2.7% y-o-y) with a YTD sales of 204,232 units (+19% y-o-y).

YTD, Perodua has achieved 65% of 2023 target of 314,000 units. For August alone, Perodua recorded a sale of 31,111 units (+9% m-o-m; +20% y-o-y). Sales of affordable car models such as Axia, Myvi, Bezza, Alza and Ativa will continue to drive monthly sales volume growth going forward, the research house forecast.

Proton took the runner-up spot, with its cumulative market share increasing by 2% to 20.6% with 102,800 units sold YTD. In August, Proton sold 13,693 units (+4.6%, -8.4% y-o-y). Proton has begun exporting its X90, with the SUV making its debut last month in Mauritius, South Africa and Brunei.

AmBank Research’s top picks for the sector are Bermaz Auto (buy, FV: RM3.10/share) and MBM Resources (buy, FV: RM5.22/share) due to strong order backlogs, new model launches and upgrades as well as high FY23F dividend yields of 7% for Bermaz Auto and 8% for MBM Resources.