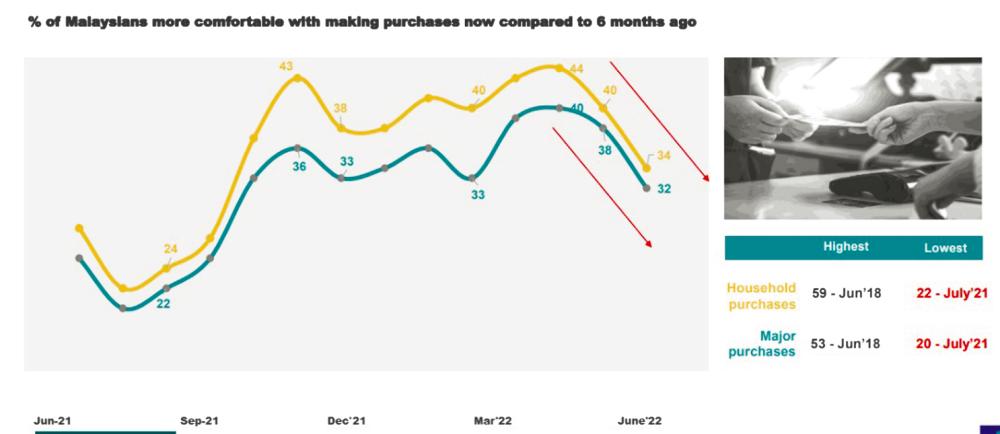

PETALING JAYA: The steady improvement from July 2021 in consumer purchase intent for household or major purchases such as house or automobiles has reversed as purchase intent dropped 10 points over the last two months, a study by market research company Ipsos Sdn Bhd found.

It said the squeeze from inflation and rising interest rates is impacting consumers’ willingness to spend. A sharp drop in Malaysian’s comfort in making both household and larger purchases indicate that they may need to prioritise what they choose to spend on in the near term.

If the new economic situation makes it necessary, Malaysians will cut their spending on socialising and holidays, and are prepared to delay larger purchases, rather than cutting the budget for necessities. The study said this mirrors global sentiment.

According to the study, the majority of Malaysians are finding it difficult to manage financially, or feel they are just getting by. Compared to most major economies in Asia and the West, significantly fewer Malaysians would say they are living comfortably these days.

Additionally, Malaysians expect further increases in interest rates, and the majority has settled into the idea that they will not see any increase in disposable income over the next year.

Inflation and poverty have eclipsed the Covid-19 pandemic as the main things Malaysians worry about.

Ipsos Malaysia public affairs associate director Lars Erik Lie said concern about inflation and the cost of living is now widespread, and Malaysians are feeling the squeeze on their personal finances.

“Widely expected increase in interest rates is preparing four out of 10 Malaysians for lower disposable income in the near future, resulting in a fall in their standard of living,” he said.