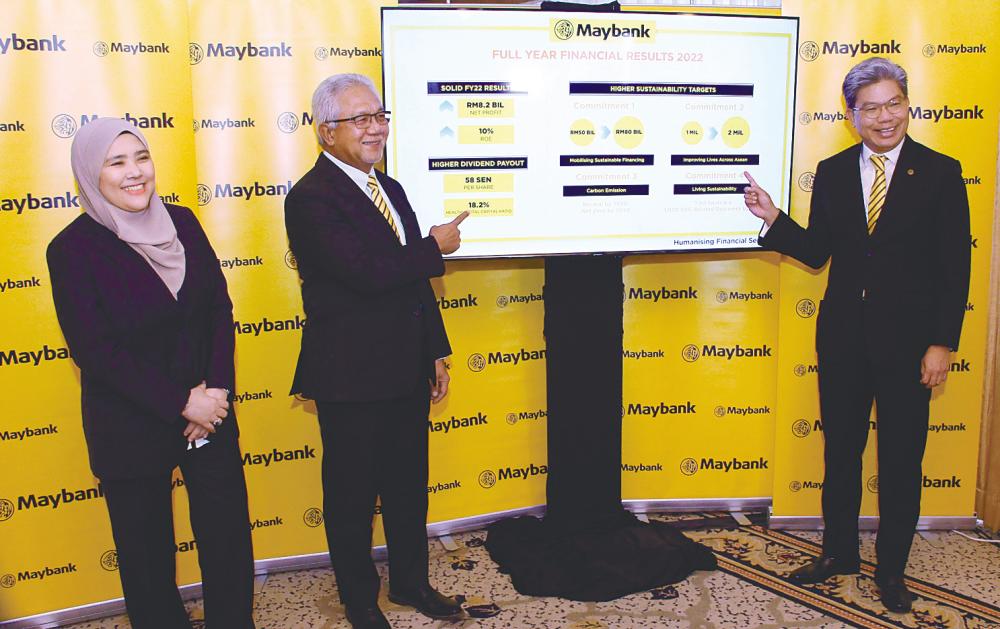

KUALA LUMPUR: Malayan Banking Bhd (Maybank) recorded a marginal increase in net profit for financial year 2022 (FY22) ended Dec 31, 2022 to RM8.23 billion from RM8.1 billion in FY21 while revenue for the year increased 10.8% to RM50.91 billion from RM45.96 billion on the back of higher net interest income and income from Islamic Banking Scheme operations – offset by higher unrealised mark-to-market loss on revaluation of derivatives, net loss in investment income and lower fee income.

Maybank’s performance for FY22 was supported by higher net interest income and income from Islamic Banking Scheme operations which increased 8.4% as a result of stronger loans growth in its Malaysia and Indonesia markets as well as an expansion in net interest margin (NIM) of seven basis points on higher interest rates.

The group’s net earned insurance premiums from the insurance and takaful subsidiaries also increased by RM130.8 million to RM8.98 billion.

Other operating income increased 3.5%, mainly due to higher unrealised mark-to-market gain on revaluation of financial liabilities at financial investments at fair value through profit or loss (FVTPL), higher net foreign exchange gain, higher realised gain on derivatives, lower unrealised mark-to-market loss on revaluation of financial assets designated upon initial recognition at FVTPL and realised loss on financial liabilities at FVTPL.

The increases were, however, offset by higher unrealised mark-to-market loss on revaluation of derivatives, net loss in investment income and lower fee income.

The group’s overhead expenses also increased 11.2%, mainly due to higher personnel expenses, higher marketing expenditure, higher administration and general expenses and higher establishment costs. The group’s allowances for impairment losses on loans, advances, financing and other debts decreased 17.7%.

For the fourth quarter ended Dec 31, 2022 (Q4’22), Maybank recorded a 5.4% increase in net profit to RM2.17 billion from RM2.06 billion on the back of 28.9% revenue increase to RM14.51 billion from RM11.26 billion as growth in net interest income and other operating income more than offset headwinds from higher provisions, impairments and overhead expenses.

It has declared a second interim dividend of 30 sen. Together with the first interim dividend of 28 sen per share earlier, the full-year dividend stood at 58 sen.

Maybank Group president and CEO Datuk Khairussaleh Ramli said it expects a five to eight basis point deterioration in NIM this year with the stabilisation of the overnight policy rate increases as well as the competition for loans growth and deposits.

“And we do expect our cost-to-income to increase to 47% given the investment we need for M25+, before it normalises again come 2025, which is why we need our deposit to grow to fund our asset growth,” he told reporters at its full year financial result briefing today.

Maybank had earlier announced that it will invest between RM3.5 billion and RM4.5 billion to implement M25+, of which 77% of the total investments will be for technology.

Going forward, Khairussaleh said that this year it sees opportunities to grow via its community financial services, which include SME, mortgage, wealth business, insurance, and global banking businesses across the region.