THE business environment continues to evolve due to the Covid-19 pandemic and Public Bank has been at the forefront in assisting small and medium enterprises (SME) to deal with the new normal.

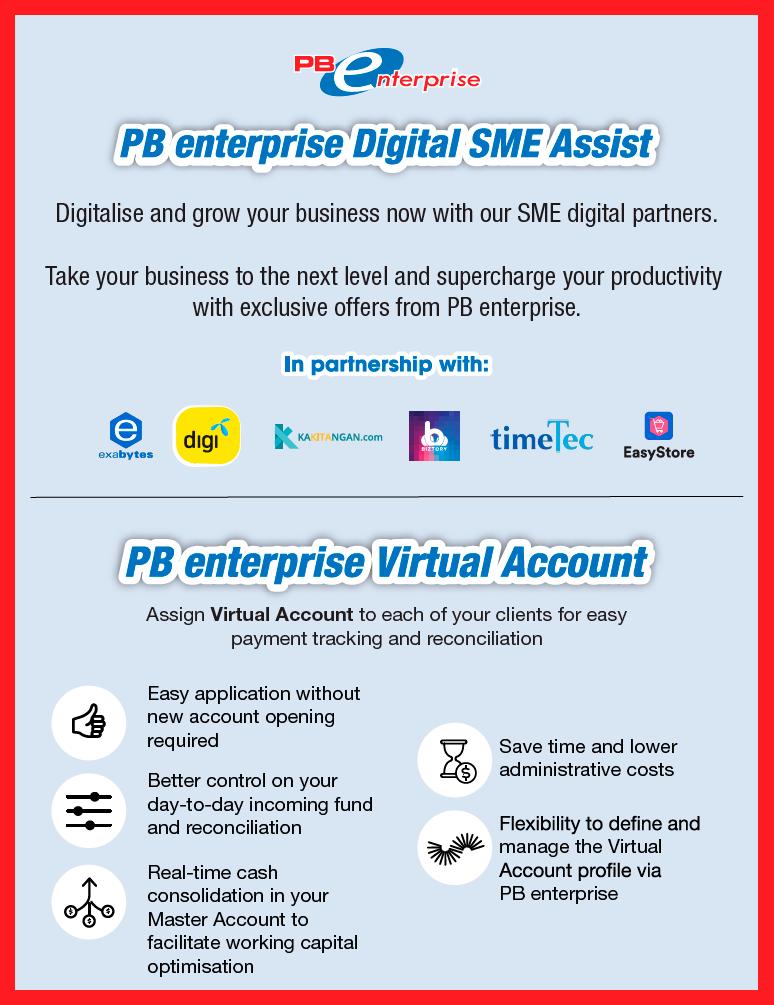

The PB enterprise Digital SME Assist programme launched since mid-April this year has been supercharging digitalisation initiatives for SMEs. Collaborating with tech companies, the programme offers SME multiple tools that makes doing business easy by giving decision makers the information they need at their fingertips while allowing them to focus on big picture ideas for scalability and expansion plans.

This programme also helps to support the nation’s homegrown tech companies including cloud accounting system Biztory; online human resources system Kakitangan.com; e-commerce solution provider EasyStore; workforce and property management solution provider TimeTac; as well as digital marketing platform Exabytes. The programme is also done in collaboration with telco Digi.

Such triple wins for our nations’ SME, tech companies and Public Bank is an epitome of the future of doing business where collaboration is pivotal and digitalisation is critical.

To further offer SME an edge in digitalisation, Public Bank offers the PB enterprise Virtual Account service. This simplified cash management service enables companies to quickly and accurately trace and reconcile payments at various scale. A huge advantage from the traditional bookkeeping and payment reconciliation practices which requires a lot of time and physical eyeballing effort, the PB enterprise Virtual Account service addresses all this, mitigating omission errors and inaccurate records in the process.

Public Bank’s PB enterprise Virtual Account service also helps to modernise business payment operation and improve cash collections through real-time cash consolidation and effective accounts receivable reconciliation.

Hence, with SME being increasingly tech savvy and digitally capable, conventional banking solutions are no longer sufficient and Public Bank’s PB enterprise Virtual Account service is the simplified cash management solution that SME have been waiting for – supporting them to do business in the new norm and digital era with increased profitability and efficiency.

For further details and enquiries, customers may visit any Public Bank branches, log on to Public Bank’s website www.pbebank.com or email cms@publicbank.com.my.