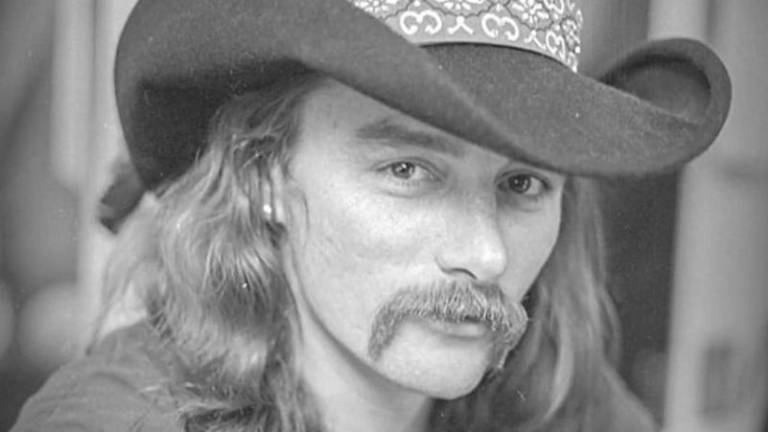

PETALING JAYA: Malaysia’s economic recovery remains on track with a 5.2% growth forecast, but it could be dampened by prolonged supply chain disruption, persistent high inflation, and sharp slowdown in China with global stagflation pressures now a serious risk, according to Socio Economic Research Centre Malaysia (SERC) executive director Lee Heng Guie (pix).

“The supply chain disruption is worsened by Russia’s invasion of Ukraine, which has induced massive negative supply and price shocks. Persistent high inflation and high oil price shock represent a double blow to the world economy that could impact growth momentum. The sharp slowdown in China and the lockdown in its major cities could have further impact on the regional supply chain and hence on Malaysia,” Lee said during SERC’s first-quarter 2022 (Q1’22) economy tracker briefing yesterday.

Lee said the country’s economic recovery rides on the back of a stronger revival in domestic demand and a rebound in the services and the construction sectors. Services such as tourism, retail, transport, and aviation will see faster growth (6.1%) on border reopening and pent-up demand amid increased operating costs and other risks including climate change, stagflation and geopolitical tension. The construction sector is estimated to see 6.5% growth due to ongoing large infrastructure projects and small-scale projects.

Private consumption is estimated to see a 6.5% growth due to Employee Provident Fund withdrawals as well as a recovery in income and employment, but inflation and living cost concerns will dampen consumer sentiment. The labour market is gradually recovering with the unemployment rate in February 2022 at 4.2% compared with 5.3% in May 2020. Private investment (5.0% growth) continues to remain in cautious mode while public investment is forecast to see 9.4% growth.

Exports are estimated to grow moderately (4.4%) on continued external demand from key trade partners, strong global demand for electrical and electronic products and improvement in commodity production. However, external demand will slow if the global economy tanks, with higher freight and container rate and logistic costs, supply chain disruptions, as well as workers shortage and higher cost of doing business, Lee cautioned.

Imports are estimated to expand at a 4.9% rate on the continued expansion of manufactured exports and improved domestic demand.

Lee said although trade with Russia is only at 0.4% (Ukraine at 0.1%) of Malaysia’s total trade, the war has caused prices of wheat, corn and chemical fertiliser to rise, which means costlier feed, fertiliser, pesticides and other raw materials. But the European Union may purchase more palm oil as a result of shortages in rapeseed and sunflower oil supply from Ukraine.

Besides, Malaysia benefits from higher crude oil-related revenue, although it would be offset by bloated fuel subsidies and other subsidies.

In the financial market, Lee said, one can expect volatility due to the war and the situation in the commodity market. There will be a flight to quality as investors lighten their portfolios. To reform the economy beyond the pandemic, Lee said the country must be prepared to withstand any future shocks, whether financial, economic, or non-economic.

“Now there’s a reserve coming from oil, coming from commodity prices. So, (we) should save this surplus for future shocks,” he suggested, adding that the ringgit is also expected to remain weak for the rest of the year.