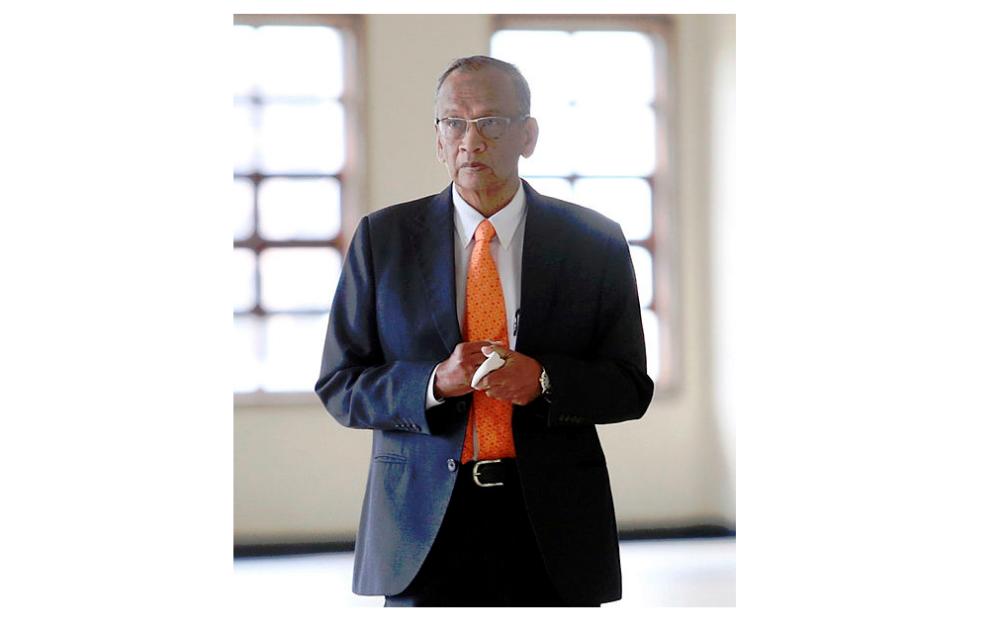

KUALA LUMPUR: Former Auditor-General Tan Sri Ambrin Buang (pix) yesterday told the High Court he was disappointed that he had to entertain the proposed amendments at the last minute while the 1Malaysia Development Berhad Audit Report was ready to be presented to the Public Accounts Committee. (PAC).

Ambrin, 70, said the final 1MDB audit report which was due to be presented on Feb 24, 2016, had to be tabled in March 2016 after several amendments were submitted by former prime minister Datuk Seri Najib Abdul Razak and 1MDB Chief Executive Officer (CEO) Arul Kanda Kandasamy.

The sixth prosecution witness said this on the fifth day of the Najib and Arul Kanda trial hearing on the amendments to the 1MDB Audit Report.

Earlier, Ambrin explained the amendments made to the 1MDB auditing reports including two different versions of the 1MBD financial statements, the issue of the suspension of Islamic Medium Term Notes (IMTN), ACME, and the issue of the presence of Low Taek Jhow or better known as Jho Low.

Explaining the issue of the two versions of 1MDB’s financial statements, Ambrin said a version sent to the Companies Commission of Malaysia stated that 1MDB had used RM4.03 billion in funds raised from the Seggregated Portfolio Company (SPC) investment to pay off the company’s debts.

Another version of the financial statement was sent to the Ministry of Finance, Deutsche Bank and AmBank stating that the RM4.03 billion in funds raised from SPC’s investment was still in 1MDB’s savings.

Explaining the delay in the issuance of IMTN which was dropped in the final 1MDB audit report, Ambrin said 1MDB’s special audit team found that on May 27, 2009, Najib, who was then prime minister and finance minister, had been asked to call on Terengganu Sultan Mizan Zainal Abidin.

“Sultan Mizan as patron of the Terengganu Investment Authority (TIA) had ordered that the issuance of IMTN investment be deferred. The adjournment was for the Special Supervisory Committee to review.

“However, on the same afternoon (May 27, 2009) a meeting of the Cabinet was held but Najib did not state or discuss Sultan Mizan’s order on the delay in issuing IMTN investment for use for the PetroSaudi Ltd (PSI) and 1MDB joint venture projects.

“The National Audit Department (NAD) considers the postponement (IMTN) should require approval from the Cabinet since the Cabinet had approved the investment of the IMTN issue initially.

“The Cabinet should be informed about the IMTN investment,“ he said, adding that in this regard, NAD included the matter in the final audit report of 1MDB.

Explaining further, the witness said in the discussion at the Feb 24, 2016 meeting, the Attorney General’s Chambers representative Tan Sri Dzulkifli Ahmad informed that the deferment of the IMTN should not be communicated to the Cabinet.

“Dzulkfili stated that it was only for the IMTN to be produced that would need the approval of the Cabinet. Based on the agreement reached at the meeting, I agreed to the issue being dropped from the report,“ he said.

Ambrin said the meeting also discussed the Country Groups Securities (CGS) Thailand agreement with ACME Time Limited owned by Jho Low, in which BNM found Jho Low’s involvement and investment in IMTN’s issuance for PSI joint venture projects with 1MDB, and no investigation was done on the matter by BNM.

“According to BNM information, AmBank signed a secondary subscription agreement with CGS on May 18, 2008 meaning that AmBank was the primary buyer of an agreement with CGS meaning that AmBank had traded its interest in IMTN to CGS where CGS was a subsale buyer.

“It was later revealed that CGS had signed a Put Option Agreement with ACME as a joint transaction partner. BNM claimed AmBank’s place out profit was US $127.27 million in which payments were made to CGS of US $ 1.30 million and ACME US $ 113.42 million and US $12.55 million. NAD has reported the matter in the draft 1MDB final audit report,“ he said.

However, he said Arul Kanda had requested that the issue be excluded from the 1MDB final audit report as he was of the view that it was outside the scope of the 1MDB audit issue as the deal involved a secondary market.

On dropping of Jho Low’s presence in the report, witnesses said former Najib’s Chief Secretary, Tan Sri Shukry Mohd Salleh had asked to drop the paragraph on Jho Low’s presence at a board meeting due to its sensitivity and to avoid the fact being distorted by the opposition.

“The removal of paragraphs relating to the presence of Jho Low, in my opinion, was intended to prevent the PAC or the readers of the 1MDB Auditing Report to know that Jho Low was present at the board meeting to approve the IMTN investment and that it affected the report to the PAC.

“I agree for this to be dropped from the report because the NAD audit team was unable to confirm documentary evidence as to whether Jho Low was actually present or not because there were two different meetings in terms of attendance,“ he said.

In addition, the court was also informed that Arul Kanda also sought to limit the scope of the report of SRC International Sdn Bhd, a 1MDB subsidiary to the period beginning Jan 7, 2011 (i.e. the date the SRC was set up) until Feb 15, 2012 (i.e. the date the SRC was transferred to the Ministry of Finance) only and not until 2014.

Former Federal Court Judge Datuk Seri Gopal Sri Ram led the prosecution while Najib was represented by lawyer Tan Sri Muhammad Shafee Abdullah, while Arul Kanda, 43, was represented by lawyer Datuk N. Sivananthan.

Najib is alleged to have used his position to direct amendments to the 1MDB Auditing Final Report before it was tabled to the Public Accounts Committee (PAC) to prevent any action against him while Arul Kanda was accused of abetting Najib over similar offences.

They were charged with the offence at the Prime Minister’s Department Complex, Federal Government Administrative Centre, Federal Territory of Putrajaya between Feb 22 and 26, 2016.

The charge under Section 23 (1) and Section 28 (1) (c) was read together with Section 23 (1) & 24 (1) of the Malaysian Anti-Corruption Commission Act 2009, which provides for a maximum jail term of up to 20 years and a fine of not less than five times the value of the bribe or RM10,000, whichever is higher, if found guilty.

The trial before Judge Mohamed Zaini Mazlan continues today. — Bernama