AS oversaturated as the mobile gaming market seems at the moment, with an infinitely revolving door cycling new apps in and barely a few months old apps out, the ecosystem appears to be stuck in a limbo.

Industry experts seem to disagree, with the recent Gaming Apps Insights Report by analytics company Adjust and AppLovin showing interesting changes the mobile gaming market has undergone in the last two years, particularly in the Asia-Pacific (Apac) region.

In the fourth quarter of last year, gaming apps installed rose by 7% year-over-year, while in January, it climbed up compared to the last year by 3%. The increase was visibly seen in titles from the racing, simulation and arcade genres.

Globally, Apac had the highest organic gaming apps installs, with countries like Singapore at 38%, the Philippines at 33%, along with Indonesia and Japan at 35%. The former three also saw players spend the most time gaming with an average of 35 minutes per session.

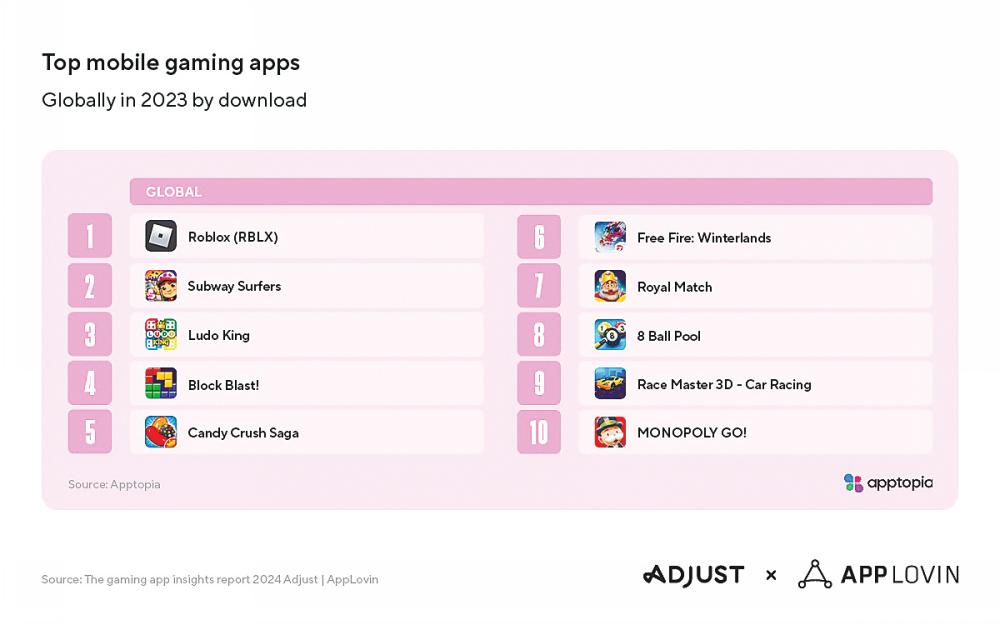

The most popular mobile games downloaded last year in Apac are Ludo King, Subway Surfers, Candy Crush Saga, Indian Bikes Driving 3D, Free Fire MAX, Roblox, 8 Ball Pool, Hill Climb Racing, Free Fire: Winterlands and My Talking Tom 2.